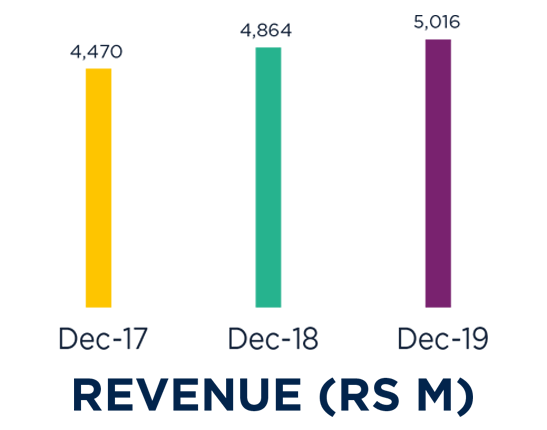

The Group’s consolidated revenue improved by 3.1% year-on-year to reach Rs 5 billion, with both the TMIT and Hospitality clusters contributing to this growth.

The Group’s operating profit rose by over 12% compared to last year, partly as a result of fair value gain on investment properties within the Hospitality cluster’s companies. The other companies of the Group, except for the Hotel, performed comparably well despite the headwinds that we had anticipated for some time.

CJ recorded a consolidated NPBT of Rs 636 million for the year under review, marginally above that of 2018. The Group’s finance cost in 2019 was negatively impacted by the borrowing costs at the level of the Hotel in its first four months of operations. In addition, higher borrowings at the level of Emtel, to cater for higher investment in network capacity and redundancy in international connectivity, have also added to this cost line.

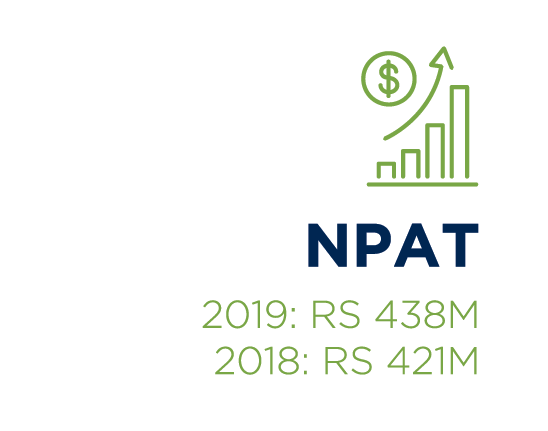

The Group NPAT stood at Rs 438 million in 2019, compared to Rs 420 million in 2018.

The Group’s Other comprehensive income was impacted by a couple of large figures, mainly driven by the performance of the Group’s quoted investments in India and adjustments to changes in retirement benefits measurements in line with IAS 19. The fair value gain on the investments attained Rs 202 million for 2019, made up of an increase in share price coupled with a favorable exchange difference. On the other hand, changes in actuarial assumptions, including the mortality experience, have negatively impacted the liability for retirement benefits to the tune of Rs 100 million in 2019.

The Group’s total comprehensive income ended the year 2019 at Rs 591 million compared to Rs 182 million in 2018, with the amount attributable to owners reaching Rs 337 million in 2019 compared to a loss of Rs 106 million in 2018.

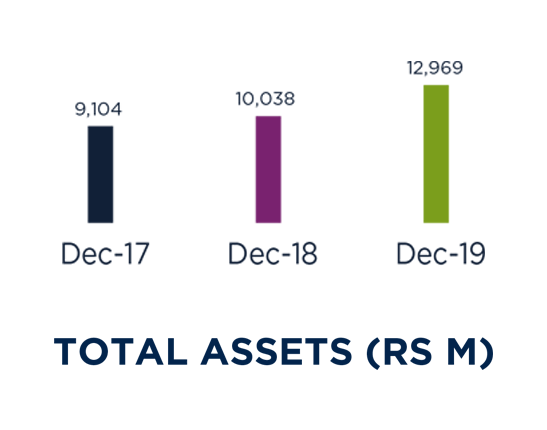

The Group’s total assets increased by 29% in 2019 to reach nearly Rs 13 billion. This was achieved mainly as a result of an increase in capex investments at the level of TMIT & Hospitality, an increase in fair value of investments and investment properties, and also changes in accounting standards pertaining to leases. The increase in capex investments has been partly financed by debt, resulting in a slight drop in our return on capital employed, from 13.25% in 2018 to 12.61% in 2019.

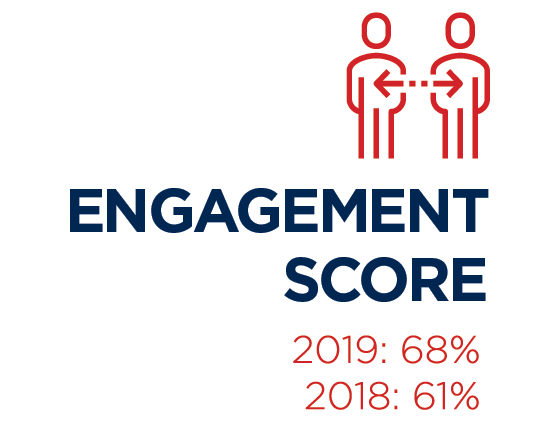

In 2019, a number of actions were initiated towards the improvement of Employee Engagement across the Group’s companies. This has positively impacted the Group’s engagement score by seven percentage points, reaching 68% in 2019.